Introduction

A potential subscriber asked us this question right before signing up:

“It’s hard for me to commit to a service that sounds this good without understanding how you manage risk for each bet.”

It’s a fair question. When money is on the line—and you’re dealing with a system that calculates its own minimum profitable odds, monitors more than 100 bookmakers in real time, cross-checks data at the snap of a finger, and tells you the exact stake based on your EV+ for each bet—it’s understandable to want the nitty-gritty details.

However, let me give you a real-life analogy to explain why not every last detail is public information.

Do you know the exact formula for Coca-Cola?

Unless you’re an insider at the company, you probably don’t. You only know you love the taste, the sparkle, and the raw pleasure when you drink it chilled with ice. You don’t know what exactly you’re drinking—only that it’s delicious.

Similarly, with WinnerOdds, you don’t need to grasp every single mathematical element to grasp that it works.

That said, we do like to explain our work—and appreciate your curiosity—so in this article, we’ll show you how we calculate the stake for each bet (while still keeping a bit of our magic under wraps).

The three key factors WinnerOdds uses to calculate bet stakes

WinnerOdds employs a proven model grounded in mathematics and probabilities. It takes three main factors into account:

1. Your bankroll

The money you allocate to betting is your starting point. Our system calculates each stake as a percentage of your current bankroll. This ensures that losses are cushioned during rough streaks—avoiding bankruptcy—and that gains are maximized during good streaks thanks to compound interest.

This point highlights the importance of setting an appropriate starting bankroll to get the most out of our service.

While the minimum recommended bankroll is €1,000, we suggest starting with at least €3,000 per sport to really maximize performance.

We once wrote a guide to figure out your recommended bankroll for WinnerOdds.

2. The positive expected value (EV+)

The second major factor is the bet’s positive expected value (EV+).

We’ve discussed the concept of EV+ in previous articles, but in simple terms, it refers to bets that are priced above what they should be based on the real probabilities of that event—thus offering a profitable opportunity.

Even though you won’t win every bet, you will be up over time if you consistently pick EV+ bets. Essentially, the higher the value per wager (relative to your bankroll), the larger the recommended stake, as more value justifies higher risk.

We measure the magnitude of the bet’s EV+ by comparing the bookmaker’s odds to our algorithm’s Minimum Profitable Odds.

3. WinnerOdds’ Minimum Profitable Odds

Lastly, our algorithm calculates the Minimum Profitable Odds (MPO), showing the exact point at which a bet becomes profitable.

In other words, if the bookmaker’s odds are above the MPO, it’s an EV+ bet.

Our MPO are actually set a bit higher than the absolute “strict minimum” because betting at exactly 0% expected yield wouldn’t be a worthwhile time investment. At our chosen threshold, you’re guaranteed a small yield—between 1–2%—so it’s always beneficial to place bets at or above the MPO.

What’s the precise formula WinnerOdds uses to calculate the amount of money to bet?

We use our own in-house approach that we’ve fine-tuned over the years.

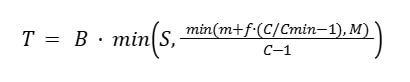

“We employ a Fractional Kelly strategy with both minimum and maximum profit limits per bet”

If we define the following terms:

T = stake size

B = bankroll

C = bookmaker’s odds

Cmin = WinnerOdds’ Minimum Profitable Odds

f = fractional coefficient (Fractional Kelly)

S = maximum stake size (as a fraction of the bankroll)

M = maximum profit per bet

m = minimum profit per bet

The formula will look something like:

It may appear like total nonsense, so let me break it down with an example:

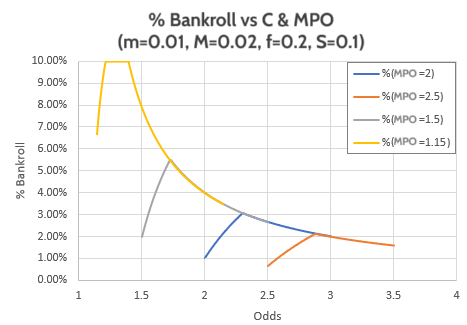

Let’s say that B = €5,000, m=0.01, M=0.04, f=0.2, S=0.1:

| C | Cmin | T |

| 2 | 2 | €50.00 |

| 2.1 | 2 | €90.91 |

| 2.2 | 2 | €125.00 |

| 2.3 | 2 | €153.85 |

| 2.4 | 2 | €142.86 |

| 2.5 | 2 | €133.33 |

Minimum profit per bet (m): We want a minimum return per bet because our time is valuable. This also means that our MPO are set a bit higher than the “real” minimum to ensure every bet we place has a small but positive expected yield.

We limit risk in three ways:

Maximum stake (S): The maximum % of your bankroll you’re willing to bet. If you set it to 10%, then S=0.1, reducing risk especially on low odds.

Fractional coefficient (f): We use a Fractional Kelly because our calculated probabilities aren’t perfect, so scaling the stake down as the value per bet increases considerably is important to reduce risk.

Maximum profit per bet (M): We limit the maximum profit on every single bet because if the bookmaker odds are drastically higher than our MPO, there’s a chance we miscalculated or the market knows something we don’t. This limit is also crucial for our risk management.

To try to put these concepts in layman’s terms:

The stake you place is a function of your EV+ and your bankroll, with three additional measures to guard against the uncertainty of our calculations.

Why do we call this a conservative system?

While the explanation above illustrates the answer, let’s put it clearly.

WinnerOdds adjusts the stake calculation parameters to optimize the ratio between profit and expected drawdown over a year. That means we consider bet value, volatility, and drawdown to hone in on the best profit-to-risk ratio while keeping your betting time worthwhile.

- Protection against drawdowns: If you hit a losing streak, your bankroll shrinks, and the system automatically lowers stakes to prevent further losses.

- Focus on volume: The long term in betting isn’t measured by calendar days, but by the number of bets you place. The more bets, the less variance affects your results.

Common mistakes to avoid

Even though WinnerOdds automates much of the process—clearly displaying your stake (here’s an example video of the interface):

The video is in Spanish, but you can enable manual English subtitles.

Some users still make fatal mistakes that could be easily avoided by following the system’s rules. Here are a few to watch out for:

Ignoring the recommended stake

This is the classic. Some people just ignore the system’s recommended stake—sometimes they prefer going “all-in” at each bookmaker, or bet less on low odds out of fear. Either approach can disrupt your risk control and increase variance. Please keep this in mind when evaluating your results.

Constantly changing your bankroll

Another major pitfall involves overly active bankroll management. Some users keep adjusting it based on intuition or “gut feelings.” For instance, a common scenario is raising your bankroll when you’re on a hot streak and lowering it after a few losses.

This wouldn’t be problematic if we could predict exactly when the good and bad streaks will arrive.

If we could actually predict when the winning and losing streaks will come, it would be a fantastic strategy. The issue is we have no way of knowing. Tweaking your bankroll too frequently can create high-risk situations.

Imagine you started with a €1,000-2,000 bankroll, and your first month was fantastic, netting you 30 units of profit. Seeing how well the system is doing, you decide to increase your bankroll to €5,000—and then, lo and behold, a bad week comes in, axing 5–6 units.

Since your bankroll is now 5 times larger than it was when you booked those initial gains, you could be worse off in absolute terms—even if you’ve made a net gain in units. You won those 30 units with a small bankroll, but lost 5 units with a much bigger one.

Moral of the story: Don’t tamper with your bankroll. Leave it on automatic or keep it fixed, but leave it alone.

Giving up in the short term

This one’s simple, and though it’s not directly related to the stake size, many users can’t see the long-term potential of the service and quit too early.

As we like to say, their time limit ends at their first drawdown, which becomes a big problem for anyone aiming to make serious money through sports betting.

The Kelly formula and the WinnerOdds system are designed to work long-term. If you give up after 100 bets, you won’t come close to obtaining the expected results.

Being oblivious to the importance of volume

The more money you can invest in value bets, the more profit you’ll ultimately make. A 3% yield on €300,000 wagered is night and day compared to 3% on €30,000.

When we say WinnerOdds is a high-volume system, we mean precisely this: You need to put enough money into action so that a 5% yield becomes something big.

That’s why we have a feature called “automatic bankroll calculation” that adds your winnings back into your bankroll, continuously updating your stake calculations.

Hence, that 5% average is applied every time you wager your entire bankroll, on an ever-increasing amount:

– 5% of €1,000 → €1,050

– 5% of €1,050 → €1,102.50

– 5% of €1,102.50 → €1,157.62

– 5% of €1,157.62 → €1,215.50

And so on…

Therefore, to maximize your return on investment, keep these four points in mind:

- Try to start with at least a €3,000 bankroll

- Keep “automatic bankroll calculation” enabled

- Place as many bets as possible without ruling out any odds ranges

- Commit to the long term

The more bets you complete, the more stable your results will be. The system requires a significant volume to smooth out variance.

Common questions

In this section, I’ve gathered some of the most common questions our users have asked over the years. I hope that after reading this entire article, they help you understand the service and its full potential.

If I want to wager more than the amount WinnerOdds recommends, is it okay to multiply the displayed stake by 5 or 10?

You can do that, but we don’t recommend it. Ultimately, WinnerOdds’ calculations serve two fundamental purposes: maximizing your earnings during profitable streaks, and shutting down the risk of bankruptcy when bad streaks come.

If you decide to ignore those guidelines and apply your own criteria, understand that you’re very likely taking on more risk than is justified—even if each bet has positive expected value.

If you’re not sure what you’re doing, the best approach is to stick to the recommended stakes. Don’t complicate your life unnecessarily going against a system that has succeeded for nearly 10 years.

Do the Minimum Profitable Odds have an extra margin of profit? What would my expected yield be if I always bet on the MPO?

WinnerOdds’ Minimum Profitable Odds contain a profitable margin so that the time you spend betting is worthwhile. In other words, the exact minimum profitable odds are slightly under what the system displays.

Should I wager the recommended stake as soon as I receive the bet notification, or wait until the odds shift?

It’s best to bet as soon as WinnerOdds releases a pick. We have no evidence suggesting that waiting is better—quite the opposite, as waiting only increases the chances that you won’t be able to place the pick before the odds drop.

Your speed in placing bets and your availability to do so will let you place more picks, which equals more volume, which equals higher long-term profit.

If I placed a bet, and later the MPO shift above my bet, should I cash out or let it ride? If I can cash out at no cost, should I?

This situation can arise due to our Dynamic Minimum Profitable Odds, and is one of the questions that comes up repeatedly. We have an article that explains why it happens and the advantage of having Dynamic MPO:

Value Bets with Dynamic Minimum Profitable Odds

In this case, we recommend you let the bet run and never cash out, because cashing out means paying double or triple commission at the bookmaker.

The only exception is if you can cash out at zero cost—in that case, it might be an acceptable option, provided the Dynamic MPO had a major shift and you feel uneasy about that particular bet.

Why do the stakes in the full historical records sometimes differ from what I see on the odds page?

This happens because the full historical records always use a static bankroll, and the odds per bet are those taken by the first user to place each bet (they aren’t necessarily the best possible odds, but they’re typically above the average odds taken by our entire user-base).

Essentially, what you see there is a simulation using a constant bankroll, at whichever odds the fastest user grabbed, and placing 100% of the system’s bets.

Conclusions

Just as many people want to know Coca-Cola’s secret formula, some folks ask us for the exact risk calculation per bet or the precise margin we apply above the Minimum Profitable Odds.

That’s our true advantage—our defensive moat—and the key factor that differentiates us from other services.

In this article, we’ve tried to give you enough insight into the basics and the rationale behind our methodology, though we hope you understand we can’t reveal every drop of information.

And we can’t—for the same reason that Freeway Cola doesn’t taste like Coca-Cola—it’s the defining factor that sets us apart.